louisiana inheritance tax waiver form

REV-1381 -- StocksBonds Inventory. State of Louisiana Department of Revenue PO.

Looking For A Nj Tax Forms And Templates Download It For Free

Property Subject to Tax Inheritance taxIn general inheritance tax is im- posed upon all property received by inheritance legacy or any donation or gift made in contemplation of death.

. Some states levy an inheritance tax on money or assets after they are passed on to a persons heirs. Federal Estate Tax Return Form 706 2 Ratio of assets attributable to Louisiana Louisiana gross estate to federal gross estate per federal return 3 State death tax credit attributable to Louisiana Multiply Line 1 by Line 2 4 Basic inheritance tax From Schedule III 5 Tax reduction under Act 818 of 1997 See instructions. Pennsylvania Inheritance Tax Safe Deposit Boxes.

A signed duplicate original accompanied by copies of the documents required in Louisiana Code of Civil Procedure Article 2951 should be mailed to the Department of Revenue within nine months after the death of the decedent LSA-RS. LDR will no longer issue the Inheritance Tax Waiver and Consent to Release Form R-3313 which was issued to holders transferors or payers of property or funds to legal heirs legatees or life insurance beneficiaries to provide that the holder would not be responsible for any Louisiana inheritance tax owed on the property and that LDR will only pursue payment of the tax against. Tax Release inheritance tax waiver forms are no longer required by the Ohio Department of Taxation for estates of individuals with a date of death on or after January 1 2013.

The potential INCOME tax rate on that built in gain even if all of it is classified as a capital. Louisiana Inheritance and Gift Tax. In addition no Consents to Transfer Form IH-14 personal property or Notice of Intended Transfer of Checking Account.

REV-714 -- Register of Wills Monthly Report. If youre looking for more guidance to navigate the complexities of Louisiana inheritance laws reading up on them beforehand will be a huge help. 1 Total state death tax credit allowable Per US.

The estate transfer tax is calculated by determining a ratio of assets included in the federal gross estate attributable to Louisiana to the total federal gross estate. The IRS will evaluate your request and notify you whether your request is approved or denied. By clicking continue you consent to being directed to this third party site.

Its also a community property estate meaning it considers all the assets of a married couple jointly owned. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed. While the estate is responsible for paying estate taxes beneficiaries must pay inheritance tax.

Louisiana does not have an inheritance tax Inheritance tax laws from other states could in theory apply to you if you inherit property or assets from someone who lived in a state that has an inheritance tax. Ad Register and Subscribe now to work with legal documents online. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

Louisiana does not impose any state inheritance or estate taxes. REV-1197 -- Schedule AU -- Agricultural Use Exemptions. Estate Planning Annotations Agricultural Law and Tax.

Request for Louisiana Tax Assessment and Lien Payoff 09012010 - present. You are being directed to a third party site to submit this form electronically. Benefciary an inheritance tax waiver for states.

The Louisiana Estate Transfer Tax is designed to take advantage of the federal tax credit. Easily Download Print Forms From. It operates almost like an inheritance tax on the heirs but it is much more severe and it is levied through the INCOME TAX SYSTEM.

Inheritance tax was repealed for individuals dying after December 31 2012. Form 8508-I To request a waiver from the electronic filing of Form 8966 FATCA Report use Form 8508-I Request for Waiver From Filing Information Returns Electronically For Form 8966 PDF. This ratio is applied to the state death tax credit allowable under Internal Revenue Code Section 2011.

Dont confuse estate tax with inheritance tax. All groups and messages. Blank Forms PDF Forms Printable Forms Fillable Forms.

REV-1313 -- Application for Refund of Pennsylvania InheritanceEstate Tax. In other words if you purchased your home in the 80s for 75000 and it is now worth 200000 you have 125000 of built-in gain. REV-720 -- Inheritance Tax General Information.

However tax release forms are not required to be obtained for assets passing to a surviving spouse alone regardless of the dollar amount. Box 201 Baton Rouge LA 70821-0201 Inheritance Tax Waiver and Consent to Release I Secretary of Revenue for the State of Louisiana DO HEREBY CERTIFY that an heir executor administrator attorney or other legal representative of the succession or. Louisiana State Income Tax Penalty And Interest Hunters Needs.

Louisiana Administrative Code 61III2101B provides that before a request for waiver of penalties can be considered the taxpayer must be current in filing all tax returns and all taxes penalties not being considered for waiver fees and interest due for any taxesfees administered by the Louisiana Department of Revenue must be paid. No tax has to be paid. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

Form 0-1 is a waiver that represents the written consent of the Director of the Division of Taxation to transfer or release certain property in the name of a decedent. Ad inheritance tax exemption. The portion of the state death tax credit allowable to Louisiana that.

This includes real or personal property any right or interest therein or any income received therefrom subject to tax under the Louisiana Inheritance Tax Law and under the Louisiana. Under the federal estate tax law there is a credit for state death taxes that are paid up to a certain amount. Inheritance tax An original inheritance tax return is to be filed in the succession record.

PdfFiller allows users to edit sign fill and share all type of documents online. Louisiana does not have an inheritance tax. What is an Inheritance or Estate Tax Waiver Form 0-1.

Louisiana has completely eliminated taxes on any inheritance but for estates that are large enough to require a federal estate tax return there is a Louisiana Estate Transfer Tax.

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

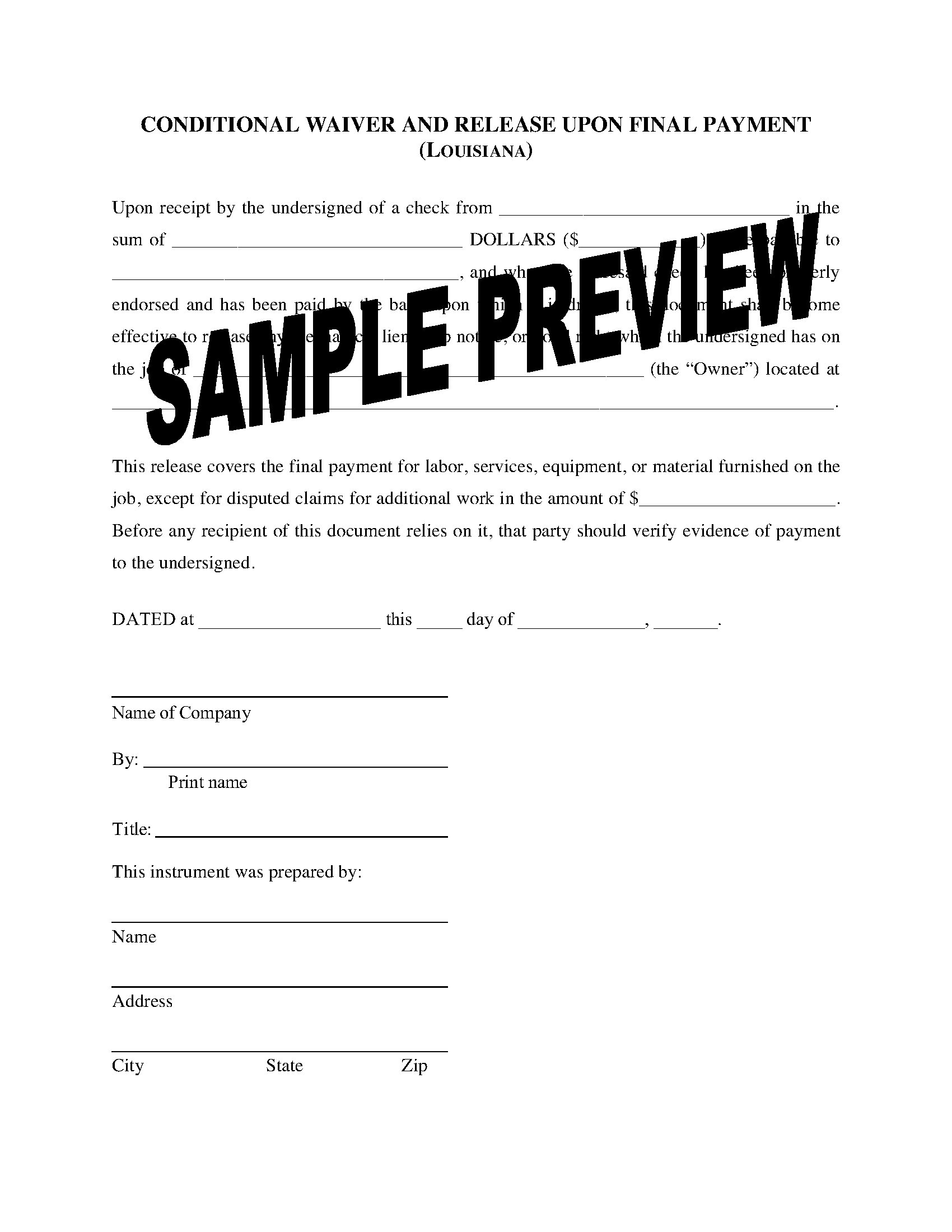

Louisiana Lien Waiver And Release Forms Package Legal Forms And Business Templates Megadox Com

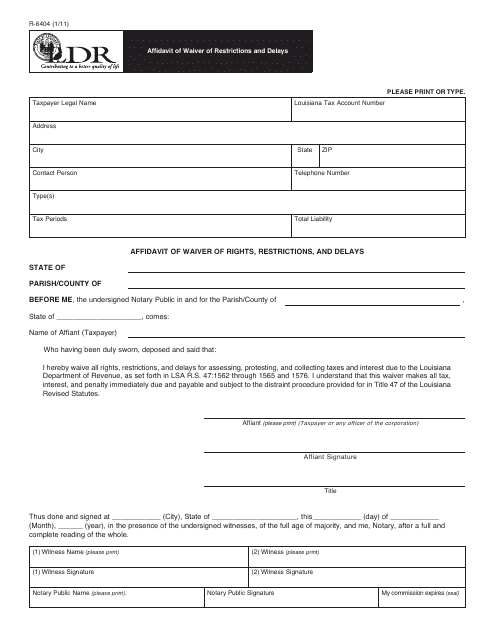

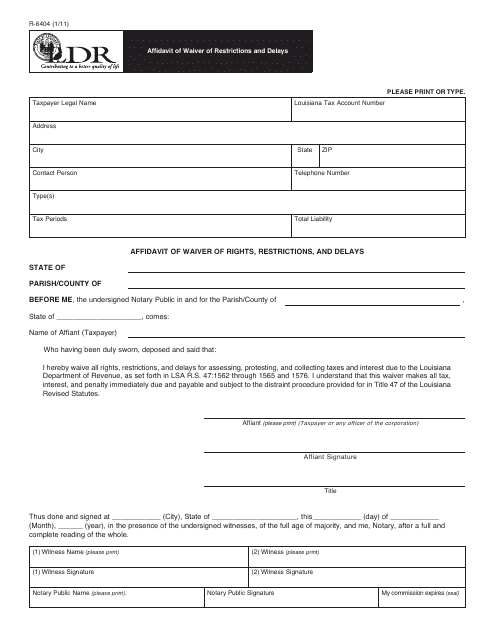

Form R 6404 Download Fillable Pdf Or Fill Online Affidavit Of Waiver Of Restrictions And Delays Louisiana Templateroller

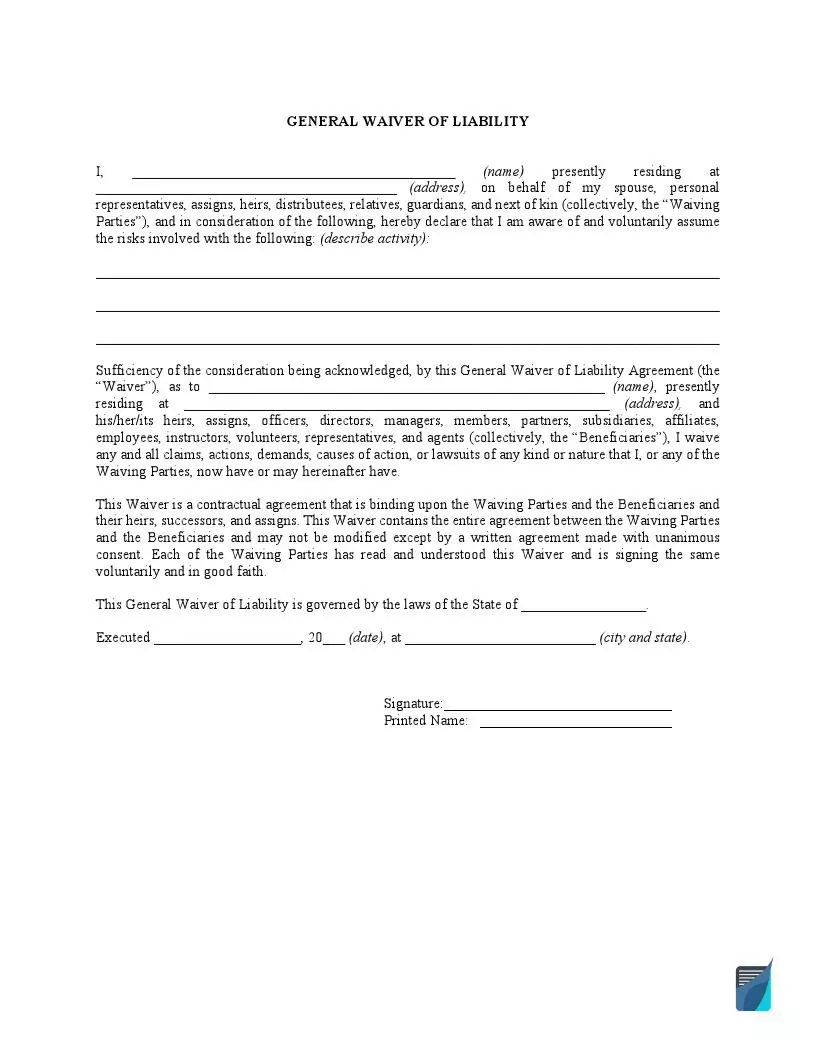

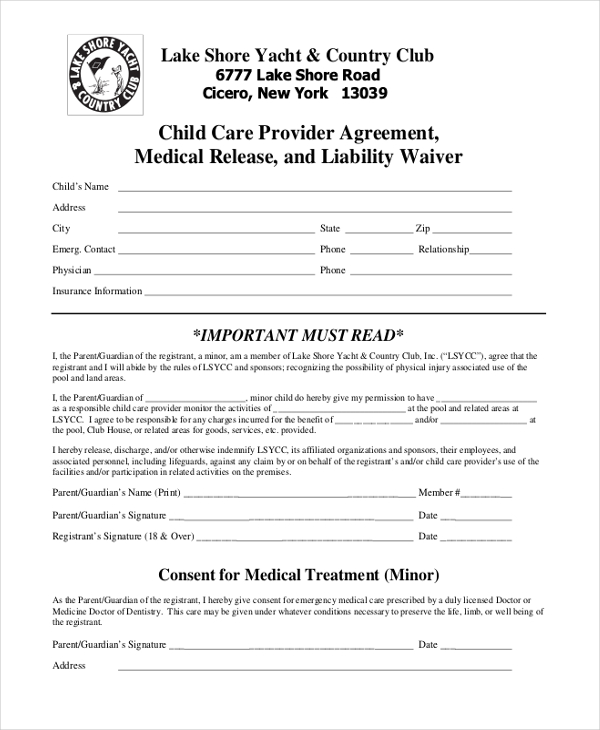

Liability Waiver Form Template Free Elegant Index Of Cdn 29 2007 569 Liability Waiver Reference Letter Templates

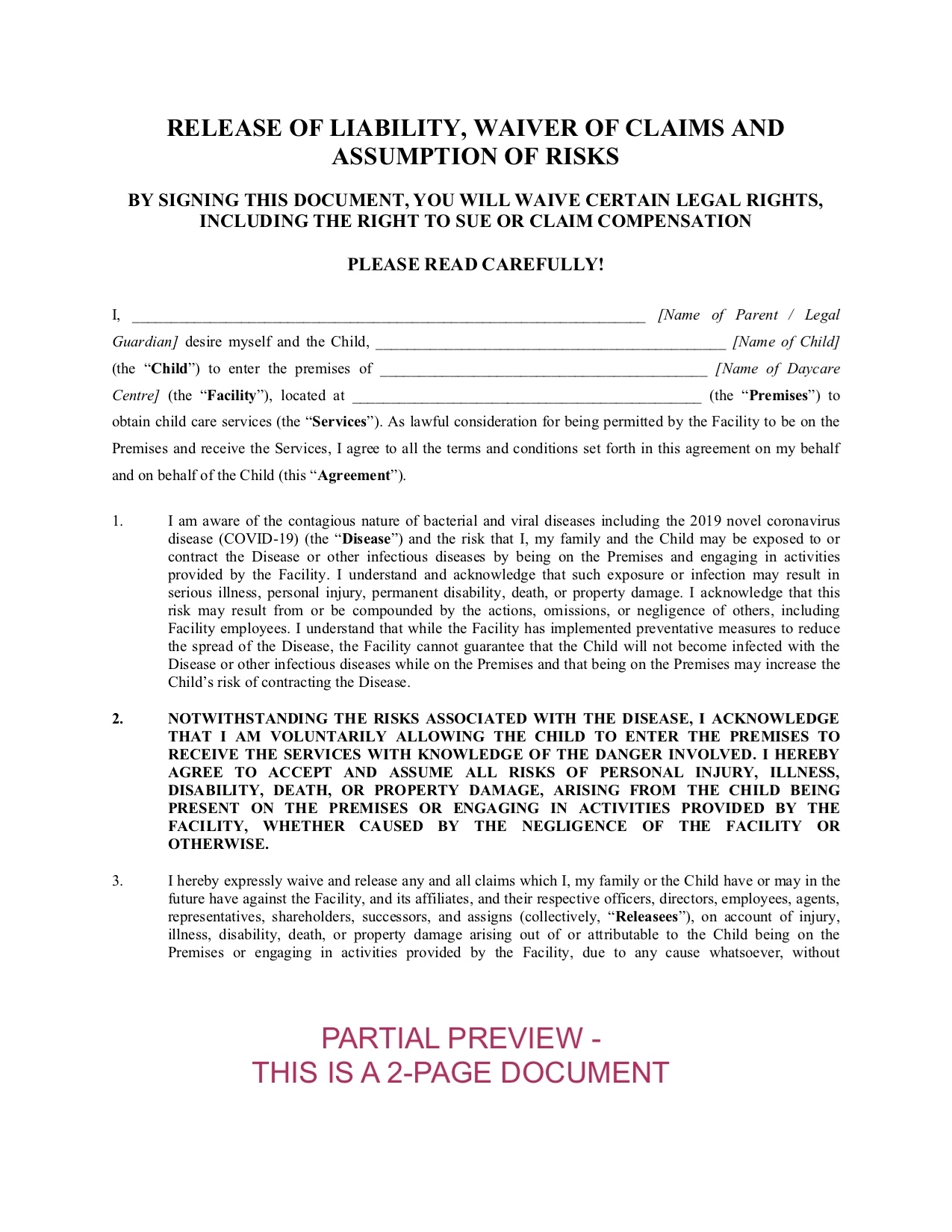

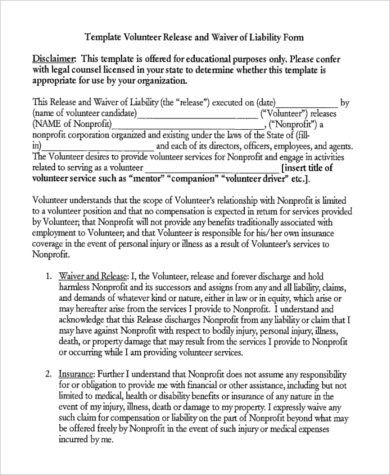

Free Release Of Liability Template Faqs Rocket Lawyer

Free 11 Sample Liability Release Forms In Pdf Ms Word Excel

Sample Waiver Form Free Printable Documents Liability Waiver Free Basic Templates Smart Goals Template

91 Direct Debit Form Template Page 4 Free To Edit Download Print Cocodoc

Canada Covid Release Of Liability Form For Daycare Center Legal Forms And Business Templates Megadox Com

Hawaii Rental Application Download Free Printable Rental Legal Form Template Or Waiver In Different Edi Rental Application Application Download Hawaii Rentals

Lease Agreement Archives Page 97 Of 139 Pdfsimpli

Free 6 Sample General Release Of Liability Forms In Pdf Ms Word

Lease Agreement Archives Page 97 Of 139 Pdfsimpli

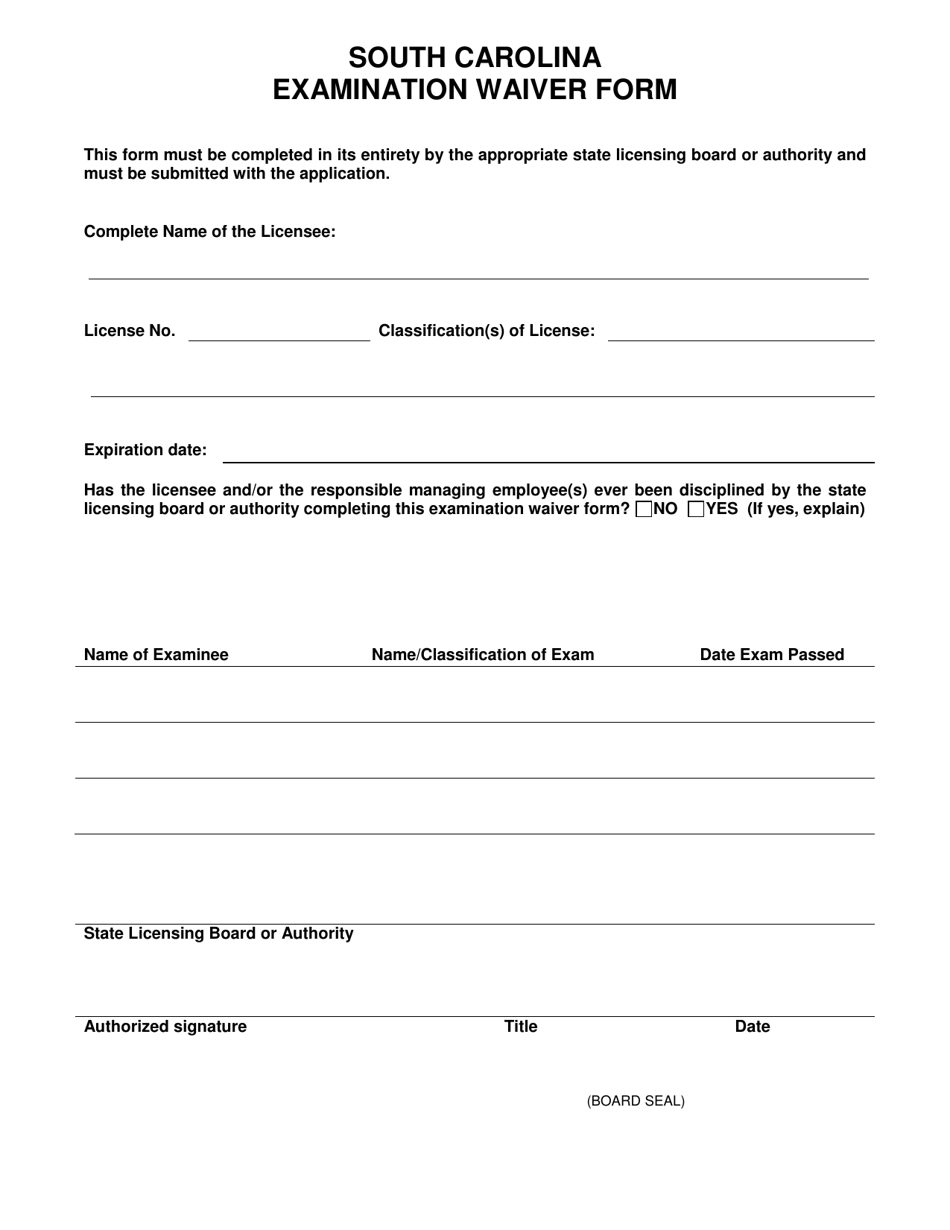

South Carolina South Carolina Examination Waiver Form Download Printable Pdf Templateroller

Damage Waiver Form Template Inspirational Sample Waiver Of Liability 8 Examples In Pdf Word Liability Waiver Good Essay Contract Template

General Release Of Liability Form Template Liability Waiver Liability Business Letter Template

6 Printable Liability Waiver Form Pdf Templates Fillable Samples In Pdf Word To Download Pdffiller

20 Printable Liability Waiver Form Pdf Templates Fillable Samples In Pdf Word To Download Pdffiller