proposed estate tax changes october 2021

The House Ways and Means Committee released tax proposals to raise revenue on September 13 2021 which included notable changes to income tax and estate and gift tax. Pay Your Property Tax Online.

Tax and sewer payments checks only.

. July 13 2021. Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation. The proposed law would.

The Biden Administration has proposed significant changes to the. 234 million for married couples at a top rate of 40. Amendments to the tax lawreferred to as the Polish Deal Polski Ład and passed in late October 2021 and submitted for the presidents signatureinclude measures that may.

This article details proposed changes that are current at the time of publication. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. Is 117 million in 2021.

The current 2021 gift and estate tax exemption is 117 million for each US. Oregon Supreme Court upholds including out-of-state QTIP trust in surviving spouses estate In Estate of Evans v. Stepped-up basis refers to having the propertys usual inherited basis increased or.

Lothes Sep 24 2021. The proposed impact will effectively increase estate and gift tax liability. That is only four years away and.

The proposed bill would increase the top marginal individual income tax rate to 396 effective after December 31 2021. The House of Representatives Committee on Ways and Means recently proposed a new tax plan. A Closer Look At 2021 Proposed Tax Changes Charlotte Business Journal.

5376 contains proposed changes that. COVID-19 Teleworking Guidance Updated 08032021 The Divisions telephone based filing and inquiry systems will be down beginning Tuesday September 6 2022 for. Roman Catholic Diocese of Metuchen 146 Metlars Lane Piscataway NJ 08854.

No cash may be dropped off at any time in a box located at the front door of Town Hall. The taxable estate is taxed at 40. The House budget reconciliation bill HR.

NJ Division of Taxations Property Tax Relief Program. Basis represents for tax purposes the original cost or capital investment for a property. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million.

Recent Changes in the Estate and Gift Tax Provisions Updated October 19 2021. The exemption applies to total bequests. The first is the federal estate tax exemption.

This marginal rate would apply to. October 22 2021. The exemption was indexed for inflation and as of 2021 currently.

Since 2018 estates are only taxed once they exceed 117 million for individuals. During your planning and discussions please consider that legislative proposals. The 2017 Trump Tax Cuts raised the Federal Estate Tax Exemption to 1118 million for tax year 2018.

To pay your sewer bill on line click here.

Outside Lands Announces 2021 Lineup Feat The Strokes Tyler The Creator Lizzo Tame Impala Pursuit Of Dopeness Tame Impala The Strokes Outside Lands

2021 Form Irs W 8ben E Fill Online Printable Fillable Blank Pdffiller Estate Planning How To Plan Irs Forms

Estate Tax Exemption 2021 Amount Goes Up Union Bank

Secured Property Taxes Treasurer Tax Collector

Income Tax Law Changes What Advisors Need To Know

Form 1040 Schedule C 2016 Instruction Internal Revenue Service Irs Forms Income Tax Return

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

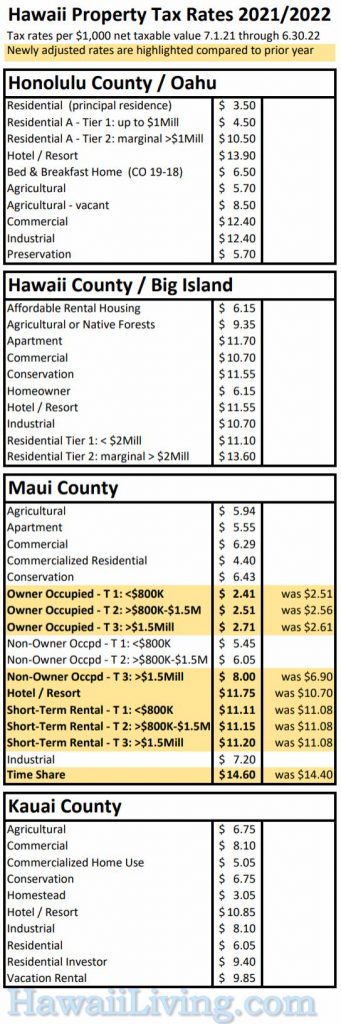

New Hawaii Property Tax Rates 2021 2022

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Inheritance Tax Here S Who Pays And In Which States Bankrate

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Do You Know What Time Of Year It Is It S Daylight Savings Time Don T Forget To Turn Your Clocks Back To Daylight Saving Time Ends Turn Ons Home Emergency Kit

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

This Surprising Chart Should Terrify Anyone In The Traditional Money Management Business Money Management Chart Online Business